From the Winchester Star

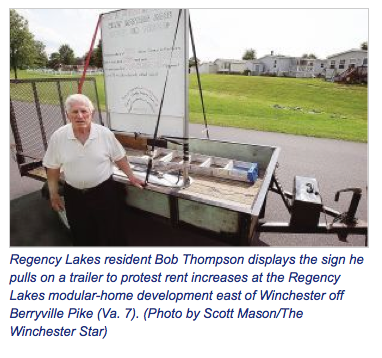

WINCHESTER — Regency Lakes homeowner Bob Thompson is accusing the billionaire owner of the modular-home development of pricing out senior citizens.

A group of homeowners from the Frederick County development, east of Winchester off Berryville Pike (Va. 7), sat around the Thompsons’ dining room table on Thursday to discuss their frustrations and concerns.

Like Thompson and his wife Nirtha, the six women gathered at the table — all seniors — own their homes, but rent the lots on which they are placed. Unlike the Thompsons, all of the women asked that their names not be revealed, saying they feared reprisal.

Nearly two years ago, Hometown America sold the development to Chicago-based Equity Lifestyle Properties (ELS), which bills itself on its website equitylifestyle.com, as “the leading operator of Manufactured Home Communities, RV Resorts and Campgrounds in North America.”

ELS has developments in 32 states and British Columbia, and owns or manages, or has a controlling interest in, more than 141,000 lots in some 380 communities, according to the website.

ELS Chairman Sam Zell was the 106th-richest person in America, worth $4 billion as of March, according to Forbes magazine. He bought the Tribune Co. — which included the Chicago Tribune, Los Angeles Times, Baltimore Sun, WGN and numerous other television stations, as well as the Chicago Cubs — in 2007. The company filed for bankruptcy the next year, and later sold the Cubs.

All but 50 of the 450 manufactured homes in Regency Lakes are owned by the residents who live in them — the majority are senior citizens, said Bob Thompson, 78.

About 250 of the homes’ mortgages are handled through ELS, he added.

When he and his wife, 74, moved into the development 10 years ago, their lot rent was $260 per month. Now it’s $465, with a $15 increase scheduled to take effect when the annual lease is up for renewal, he said.

Previously, Thompson said, the annual increases had been $20 to $25 per month, but had been reduced to $8 after he complained.

“We never thought that the rent [would] rise,” he said. “Came in and thought the monthly fee that we’re paying is what we’re going to be paying [forever].”

Some of his neighbors said they did not think their rents would remain frozen, but that the increases are too much and come too often.

They added that their utility payments have increased in recent years while their Social Security checks have remained fixed.

“Affordable living is what it’s really all about,” Thompson said.

The others gathered at his home said senior living communities are sparse, and those around the area are too costly for them.

The Thompsons believe ELS hopes to drive out most of the homeowners, take possession of their homes and rent the lots and homes together for greater profit.

Residents who no longer want to rent a lot have three months to remove their homes — transferring them to another property can cost $12,000-$15,000, Thompson said — and if they don’t comply, the development will take ownership, according to the gathered residents.

And when an owner has found an interested buyer, Regency Lakes management must give final approval, which often isn’t granted, according to the Thompsons and the other residents.

They spoke of paying about $100,000 or more for their manufactured homes, and hearing of neighbors now selling them for as little as $10,000 just to escape the lot payments.

“It’s their bigger scope to make it an all-rental [development],” he said, meaning residents would pay a combined rent for the home and lot. “It’s just not … fair that they can take these homes from us.”

While they are now paying more for their rental spaces, the services and amenities the residents receive haven’t improved, they said.

“They’re ripping people off,” Nirtha Thompson said. “They’re robbing money from these people.”

She added that the development also has young families struggling to make payments.

Thompson, a former moving company owner, and his wife, who worked at Lord & Taylor, moved to Winchester from Sterling. He said many in Regency Lakes came there for the same reasons.

“We had bigger homes and we wanted to downsize because our children moved away,” Thompson said.

The manufactured-home community was attractive because chores such as snow removal and lawn-mowing would be done for them, he said.

Thompson said that because the owners don’t have complete control of their homes when they occupy rental lots, it is difficult to persuade real estate companies to handle sales.

“The whole thing is a blind spot that we all got into,” he said.

Thompson has been keeping the community abreast of the issue, among other happenings in the park through a monthly newsletter, and is in contact with residents in other ELS communities around the country.

“What I think should happen in this particular case here is that they put a stop to or ‘grandfather’ and stop the rent increase,” he said, “because of our age. As we then die off, they do with our home [as they see fit] if they want to.”

He hopes the residents of the hundreds of other manufactured-home and mobile-home parks in Virginia will also mobilize and advocate for themselves.

Residents of a modular home community owned by ELS in San Rafael, Calif., recently won a battle against the company.

KGO-TV, an ABC affiliate in San Francisco, reported this month that a federal appeals court refused to rehear ELS’s case.

Zell had challenged San Rafael’s rent-control laws in federal court, and won, but an appeals court threw out the decision.

KGO reported that five years ago, ELS tried to raise the lot rent at the San Rafael mobile-home park from $700 to $800 a month to nearly $2,000.

A communications officer for Equity Lifestyle Properties Inc., who said she was on vacation, had not responded to questions she had asked to be emailed to her by Friday evening.

— Contact Sally Voth at

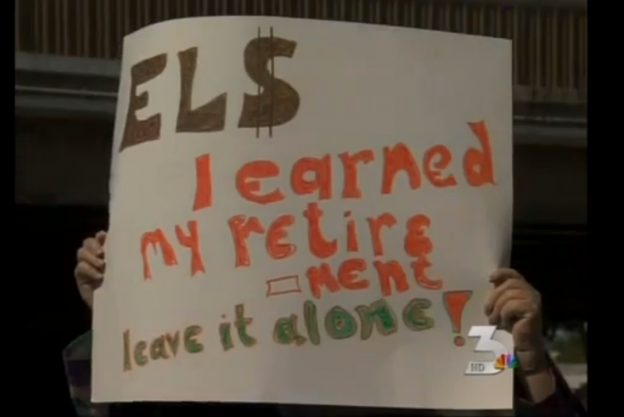

While a few demonstrators attended the meeting, several protesters rallied outside and urged Zell and other ELS executives to stop “unfair rent increases” that push residents, most of them retirees on fixed incomes, out of their homes and into poverty.

While a few demonstrators attended the meeting, several protesters rallied outside and urged Zell and other ELS executives to stop “unfair rent increases” that push residents, most of them retirees on fixed incomes, out of their homes and into poverty. Meanwhile,

Meanwhile,