Click on the links to download materials from the November 2014 MHAction gathering in Orlando:

MHAction Gathering Economy Exercise

MHAction Gathering Sunnyville Exercise

MHAction Gathering Vision and Values Session

Click on the links to download materials from the November 2014 MHAction gathering in Orlando:

MHAction Gathering Economy Exercise

MHAction Gathering Sunnyville Exercise

MHAction Gathering Vision and Values Session

In case you missed it you can listen to the audio recording of our August 12 Community Call

Includes commentary by:

**Richard Robinson, Pam Bournival and Jesse Martinez (from the MHAction leadership team)

**Renaye Manley, expert on public pension funds and corporate campaigns

Take the post-call survey here: http://www.anymeeting.com/SYID=E054D8848446

Download the retirement security 2014 Congressional recess toolkit (includes suggested actions, how-to “bird-dog”, sample op-eds and letters to the editor, and social media tools)

Download the “We Are Caregivers” storybook, including stories of manufactured homeowners who have taken time out of the workforce to care for loved ones.

Pam Bournival of Sarasota, Florida had this to say about the recent Harper’s Magazine article “The End of Retirement”

Jessica,

Your article, The End of Retirement, was a very interesting read especially since we hear almost similar stories quite often from homeowners who live in manufactured home ground rent communities. Everyone is searching for “community”, and many find it in manufactured home communities. Especially disconcerting is the way potential homeowners are enticed into the community and then they are hit with exorbitant rent increases, sometimes the very next year after moving in, along with limited maintenance and capital expenditures. The land owners, some of whom are large REIT’s answering to shareholders (many mutual funds) wanting ever increasing dividends, do just enough to make that quick first impression enticing. And they take full advantage of the fact that people do not check the fine print before signing on that dotted line. We want to believe in people, to trust people, to take them at their word . . . and then we learn the only thing which counts is what is in writing. Increased rent for new homeowners makes it all but impossible for existing homeowners to sell for even a fraction of their home’s value. When the rent is going to be so high, buyers won’t pay anything for the house.

People who have lived in a community for years or decades have seen their rents increase to such a level that it is no longer affordable. They are threatened with eviction and lawsuits, which furthers their nervousness about their future. After possibly spending many months deciding whether to pay rent or buy food or buy medicines, the brave ones just turn in the keys to their beloved home and walk away, sometimes to family and sometimes to who knows what? It could be that first step towards an RV in the desert.

You mention Social Security as a supplement to retirement. Alas, with the many pension funds decimated by greed and savings wiped out by Wall Street shenanigans, this leg of the stool is often all that is left to even the best of planners. We as a nation must stand up and speak out for doing what it takes to honor our elders and make sure they have safe, clean living environments. Social Security and Medicare need to be expanded to ensure this.

Monique Morrissey hit the nail on the head when she said that we have a reversal in economic security. Every parents’ dream is to see their children do better than they did and to not have to ask for anything from their children. What is wrong with America’s picture when so many of our precious elders are left out in the cold, in many cases quite literally?

And what does this say about corporate greed when they are presenting at conventions and gatherings where they know many of our elders will be, offering jobs which require heavy labor and offer minimal benefits? We should all feel so ashamed that we stand up in a unified voice to say it is not enough to offer aspirin so they can continue to work!!!

You cover the history of “retirement” and the belief when Social Security was initiated that many people would die before collecting. Now that we know many live well beyond the 65 years originally envisioned, more must be done to care for the retirees or our country. It is not enough to extend the age when a person can collect full benefits.

Teresa Ghilarducci states our retirees are woefully underfunded; they have small budgets for food. How healthy can they be eating? What are we as a nation going to do about this? We may believe that everyone should have planned better, but the truth of the matter is, it is so much more complicated than that. We have been in touch with the Senate Special Committee on Aging regarding the plight of manufactured homeowners and we are hoping for hearings about our issues. We must expand these hearings. We must hear from manufactured homeowners and recreational vehicle homeowners.

We invite you to hear our stories. We look forward to hearing from you. In the meantime, check out mhaction.mstudio.com and “like” us on Facebook.

Pam Bournival

Sarasota, Fl.

Originally published in the Seattle Times Thursday, June 5, 2014

With more of the middle class sliding downward and many towns banning new trailer parks, enterprising owners are getting rich renting the concrete pads and surrounding dirt on which residents park their homes.

Bloomberg News

When Dan Weissman worked at Goldman Sachs Group and, later, at a hedge fund, he didn’t have to worry about methamphetamine addicts chasing his employees with metal pipes. Or SWAT teams barging into his workplace looking for arsonists.

Both things have happened since he left Wall Street and bought five mobile-home parks: four in Texas and one in Indiana. Yet he says he’s never been so relaxed in his life.

The University of Michigan economics graduate attributes his newfound calm to the supply-demand equation in the trailer-park industry. With more of the U.S. middle class sliding downward and many towns banning new trailer parks, enterprising owners are getting rich renting the concrete pads and surrounding dirt on which residents park their homes.

“The greatest part of the business is that we go to sleep at night not ever worrying about demand for our product,” Weissman says. “It’s the best decision I’ve ever made.”

Better yet, Weissman says, the field isn’t packed with the hyper-driven geeks and MBAs who crowd technology and finance in the San Francisco Bay Area, where he and David Shlachter, his business partner and brother-in-law, both live.

“You’ve got a lot of really smart people trying to come up with a better way to put a calendar on an iPhone,” says Shlachter, who has a master’s degree in development economics from Harvard’s Kennedy School of Government. “We’d rather sit at a different poker table, where none of those people dare to go because it doesn’t sound good at a cocktail party.”

Weissman and Shlachter are part of a white-collar exodus to rougher industries, as investors seek yield amid chronically low rates or steady income after being cast out from finance or law.

In 2009, Ed Vasser left his job at a hedge fund and started investing his own capital in a wide range of down-and-dirty investments, including subsidized housing, storage units and tax liens. He’s buying part of a truck wash.

“I like to say I turned in my Rolex for a pinkie ring,” Vasser says.

The economics of mobile homes are particularly alluring to folks who’ve made their living in the markets. Many counties in the U.S. have banned or discouraged new trailer parks because the inhabitants pay little in taxes and drain resources. Yet demand is higher than ever, investors say, because so many people never got back on their feet after the recession.

David Protiva, a former mortgage-backed-bond salesman, now owns four trailer parks in Georgia. He’s noticed that until 2008, most people coming into his parks were moving up; they owned nothing before buying a trailer. Since 2009, half his residents have come to him from conventional homes, he says.

Roughly 6 percent of Americans lived in mobile homes in 2012, according to the U.S. Census Bureau. Until recently, billionaire Sam Zell and a few other investors had the market to themselves.

“We like the oligopoly nature of our business,” Zell said on a 2012 analyst conference call for his Equity Lifestyle Properties, which owns 71,500 trailer sites.

Warren Buffett targeted the industry more than a decade ago when he purchased Clayton Homes, the largest manufacturer of mobile homes. Now, private-equity firms are starting to prowl the parks.

Carlyle Group bought two in Florida in October for a combined $31 million. Both are high-end senior parks, where tenants must be 55 or over, and one is just steps from the Atlantic.

The new tycoons in the business are professionals like Weissman and Shlachter, who are willing to buy smaller, sometimes squalid parks, where tenants have damaged credit and maybe criminal records.

The sellers are often mom-and-pop owners who set up the parks in the 1960s and 1970s and have little incentive to improve them because tenants can’t afford to leave. One Colorado owner bragged to Shlachter about never plowing the snow, which saved him money.

“It’s hairy, and it’s colorful, and it’s sometimes scary,” Shlachter says.

Weissman and Shlachter take pride in improving the lives of residents in some of the more rundown parks they’ve bought. And they say owning trailer parks has taught them what it’s like to be low income in America.

Many tenants can’t get bank accounts because they have wretched credit. Instead, they use prepaid debit cards that charge a fee of as much as $4 to load just $20 onto them.

“It’s expensive to be poor,” Shlachter says.

The biggest eye-opener, they say, has been finding so many capable people banished to poverty by a stupid mistake, like getting busted for drugs. Weissman and Shlachter hire those people as managers, with, they say, excellent results. They give them incentives for collecting 100 percent of the rents on time and for finding tenants for vacant sites.

Frank Rolfe and his partner, Dave Reynolds say the 20 percent return many parks throw off annually is enough to get the genteel set over the idea of owning a community of double-wides.

Rolfe and Reynolds own 100 parks in 16 states and also run the Mobile Home University, an academy that holds three-day boot camps for aspiring trailer lords for $1,999 a person. Rolfe says an increasing number of his students are bankers and engineers.

The beauty of a trailer park for its owner is that once a tenant trucks a home to a site, then lowers it onto a pad and hooks up to the electricity and septic systems, he’s unlikely to leave. It costs at least $5,000 to move a home, a sum that trailer dwellers rarely accumulate more than once, Rolfe says.

“We’re like a Waffle House where everyone is chained to the booths.”

I’ve reflected on why I took a trip to Chicago with the MHAction leadership team, and wanted to share those reflections and my personal story with everyone.

I was born and raised in Hartley, Iowa. My father was a truck drive and we moved around quite a bit, but I’ve always felt a deep personal connection to California. Now that I’m 63, I plan on living out my years in the Golden State.

I worked a variety of jobs my entire life, mostly in retail. For the last ten years, I’ve been working as a caregiver. I feel that caregiving for the elderly, especially those with significant health issues, is a vitally important and rewarding profession. Caregiving also seems to be a “calling” for my family. My mother and sister are also caregivers.

Given that we’ve all made modest wages as caregivers, we really needed to make sure that all of us could live in an affordable setting. We felt that moving into a manufactured home community provided us with the best option to do so. We could own our own home, live in a community with others and still put food on the table and pay for our basic necessities. That’s when I decided to purchase a home in Royal Holiday, a community owned and operated by Equity Lifestyle Properties, Inc. (ELS), located in Hemet, CA.

However, if I had known as much about ELS as I do today, I would have never moved into one of their housing communities. They have raised the rent so high that many people have been forced to move out. Right now, there are over 60 vacancies in our community alone. To make matters worse, ELS has put virtually zero money into maintenance. ELS’s infrastructure strategy seems to be to charge homeowners ground rent and put nothing back into the community. Our roads, sidewalks and waterlines are crumbling apart and breaking. It’s really a disgrace.

Some days I want to hand in my keys and walk away, but given that I am now drawing my income from what I can pull together from caregiving and a meager monthly Social Security check, I’ve decided to stay and fight for my right to live out my retirement affordably. And I want to get others involved.

This is exactly why I took a recent trip to Chicago with other manufactured home owners across the country. Our main goal was to build relationships with homeowners from a number of states and sharpen our skills to make large corporations like ELS more accountable to the needs of our community. Our time in Chicago focused on skill-building sessions that ranged from telling our stories effectively to social media training. We then put our training into immediate actions by attending an ELS shareholder meeting to share our concerns, and heading to Wells Fargo, a major ELS investor, to hold a protest (pictured above). We need investors like Wells to understand how their investment decisions are impacting our community and our way of life.

I returned from Chicago with renewed hope and vigor. I plan to put to use what I learned in Chicago to make sure that I and my community members, especially the seniors, can live out our lives in an affordable and safe manner. I truly believe that our country’s strength is grounded in our ability to work together and care for each other. We are stronger when we recognize we rise or fall united, and are weaker when greed insists we be left to fend for ourselves.

I am asking you today to reach out to other manufactured home owners that are affected by these issues to get involved in the campaign. A very simple task you could ask your friends to do to get updates on the campaign is by ‘liking’ MHAction’s Facebook page.

“A golden opportunity for an increase of affordable housing is being lost to corporate greed”

Watch the video below from CBS about manufactured housing in America.

No matter what income level one enjoys, there is no question that people choose to live in manufactured home communities for just that . . . the sense of community. However, we are dismayed that the only communities shown in this report are one with hitches still on the home and one facing the Pacific Ocean. Neither of these are typical. What is typical is a community filled with homes secured into the ground, hitches removed and finishes such as carports, screen rooms and utility/storage rooms. Unfortunately, what is also typical is community owners increasing the ground rent unconscionably so that these good, hard working home owners and retirees are forced out of their home and lose their equity because the cost of owning a home and also paying ground rent becomes un-affordable. What could be a golden opportunity in this country for an increase of affordable housing in community settings is being lost to corporate greed.

Georgia Buckley and her husband William live in Salt Lake City, Utah. Several years ago, William had four strokes and a serious head injury, which turned their lives upside-down. The strokes affected everything about him, from his speech to his personality to his mental well-being.

“Basically, he had to get his life on track, and he almost had to grow up all over again,” Georgia said. Georgia said it was difficult dealing with all of the effects of her husband’s injury, but that she learned a lot. “I had to have a lot of patience, a lot of understanding,” she said.

“Basically, he had to get his life on track, and he almost had to grow up all over again,” Georgia said. Georgia said it was difficult dealing with all of the effects of her husband’s injury, but that she learned a lot. “I had to have a lot of patience, a lot of understanding,” she said.

William’s illness affected her family financially as well. When he got sick, he had to quit his job. Georgia had to get a part-time job, but even then, they couldn’t make their house payments and Georgia and William lost their home.

“We were lucky to even keep food on the table,” Georgia said. With Georgia’s help, William slowly recovered and was able to work again. They moved to a new city so he could take a job as the chief engineer of an apartment complex, but just a year later, his mother started to fall ill.

Georgia traveled 60 miles to and from her mother-in-law’s home several days a week to take her to doctor’s appointments, buy her groceries and cook her meals. As her health continued to degenerate, she became bed-ridden and relied on Georgia completely to feed and bathe her and help her to the restroom.

When William’s mother passed away, Georgia and William asked William’s father to come live with them. He was also in poor health and relied heavily on his son and daughter-in-law for day-to-day help. From helping him bathe and eat, to making sure he took his medicine, to changing his diapers and physically picking him up off the floor when he fell, Georgia became his full-time caregiver.

“It was a tough situation,” Georgia said, “especially because other members of the family didn’t know what to do or didn’t want to help. My husband looked at me and said, ‘We’ve got to do this.’ And we just did it because that’s the way we are.”

Georgia and William made their own sacrifices to become caregivers. William quit his job so that he could stay home with Georgia to help. Georgia was attending school for event-planning and interior design, but had to quit to become a caregiver.

Georgia admitted that she felt resentment toward other family members for not stepping up. “I was angry. I was angry with the rest of the family. But I’m glad that I was able to do that for my husband. I was able to step in, take charge and do what was needed to be done for him and for them.”

Georgia says if there were a Caregiver Credit, she would absolutely apply for it. Georgia and her family have sacrificed a great deal of time, energy and income in order to act as caregivers. “Caregiving is one of the toughest jobs I’ve ever had. It’s physical; it’s mental; it’s very emotional. It makes you a different person than what you are or who you ever thought you would be.”

Though both of her husband’s parents are now deceased, Georgia has not stopped taking care of others. She has begun helping her elderly neighbors across the street by taking them to doctor’s appointments, doing their grocery shopping and helping them around the house. “I’m there when they need me,” said Georgia. “I go over to help them probably four or five days a week.”

For Immediate Release: Monday, May 12, 2014

Contact: Kevin Borden, kborden@communitychange.org, (202) 360-8876

(CHICAGO)— Equity Life Styles Properties (ELS), a Real Estate Investment Trust (REIT), and the nation’s largest corporate owner of manufactured home communities is holding its shareholders meeting on Tuesday amid increased scrutiny of both their management practices and of recent statements made by its chairman, Sam Zell. Manufactured home owners from ELS communities in seven states, many of whom are seniors living on fixed incomes, will be attending the shareholders meeting where they will bring their grievances directly to ELS’ Board of Directors.

ELS currently owns 380 manufactured home communities in 32 states. These are land-lease communities in which the REIT (ELS) owns the land under the homes, which are not mobile. ELS has been facing criticism due to large rent increases coupled with decreased maintenance. This double whammy undermines the affordability of ELS communities and destabilizes these properties as long-term real estate investments. ELS recently faced a $111 million verdict in Santa Clara County, California for breach of contract, negligence and nuisance for failing to maintain one of its manufactured home developments.

“The Santa Clara County decision adds proof to the claim that ELS’ business practices are putting the health of our communities at risk. Our retirement security and home equity are being ravaged by ELS,” stated Richard Robinson, a senior who resides in an ELS-owned community in Farr West, Utah. “I’m coming to Chicago to ask ELS why they are continuing to push our rents through the roof, while at the same time allowing our community’s infrastructure to fall to pieces. In my opinion, this risky business model is putting our families’ and our communities’ financial well-being in jeopardy.”

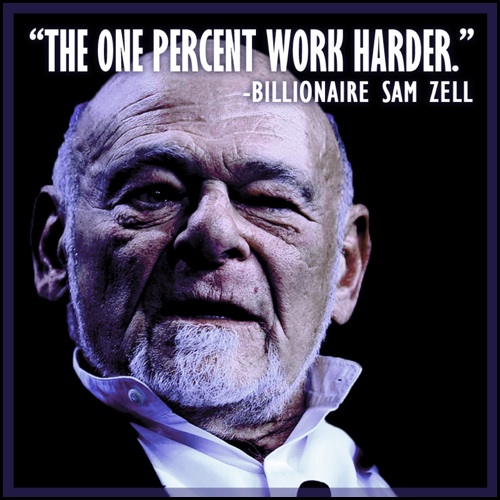

Zell is also facing a petition drive calling for his removal as ELS chairman. The petition has garnered thousands of signatures due to his recent disparaging comments made about the work ethic of those not in the top 1% income bracket in the country in a TV interview.

“It is infuriating that someone who makes millions off of monthly rents paid to his company by seniors who worked their entire lives and who are living on Social Security is questioning our work ethic,” added Pam Bournival, a home owner in an ELS Community in Sarasota, Florida. “ELS should view these comments as an embarrassment to their customer base. We feel it is in the best interests of shareholders to avoid risk posed to ELS’ marketability and ask for Mr. Zell to step down as Chairman of ELS.”

Manufactured home owners involved with MHAction, a project of the Center for Community Change Action, have called on ELS, and other REITs to re-evaluate their business models and management practices. MHAction community leaders believe the path forward for ELS and other REITS is to put in place long term lease agreements that outline a fair and balanced rent increase and capital improvement process. MHAction is also calling for ELS’s principals to support America’s retirement systems of Social Security and Medicare that the vast majority of their customers rely upon.

###

To find out more about MHAction, please visit: mhaction.mstudio.com

I am the reason Sam Zell is rich, but I’m not his stockbroker, and I’m not his business partner. I am one of the hundreds of thousands of people living in one of the 370 manufactured home communities operated by Equity LifeStyles Properties (ELS), where Zell is chairman of the board.

My home and the 140,000 like them are a large part of the reason Zell made his billions. This is the same Zell who recently commented in an interview that this country should be “emulating the one percent” because “the one percent work harder” and “are much bigger factors in all forms of our society.”

My home is also the place where my wife and I sought refuge at a very difficult time in our lives. After working decades for a delivery service company, I was severely injured in a motorcycle accident and was no longer able to work. I had to go on disability.

A year later, my wife Kathy got into a horrific accident. Kathy was driven off I-95 by a tractor trailer and critically injured. Kathy had to learn how to walk again and has undergone 32 surgeries in the last three years. I now feed, clothe and bathe her every day. I do her shopping, and I make sure she takes her medications. After she nursed me back to health, I switched roles with my wife and now act as her day-to-day caregiver.

We moved into our home in Carriage Cove, an ELS-owned community located in Daytona Beach, Florida, shortly thereafter. Carriage Cove seemed like a great option for us. We were low on savings with no future employment prospects, and the property was affordable and offered a sense of community.

At first, living there was worry-free. But since, our experience has soured. ELS used to cover water, sewer and trash pickup as a part of our monthly rent. But ELS took away those services, forced the costs on the homeowners and did nothing to reduce our rent. Our community center is falling into disrepair and has just been inspected due to a large number of safety violations. The longer we live here, the more it’s clear to us that ELS communities are operated by predatory equity schemes designed to make Zell very rich.

The people who live in ELS communities are retired citizens who have worked hard all their lives and just want a chance to live out their golden years in peace.

Take Viki D’Eugenio, a homeowner in an ELS community in Delaware who runs a small business. After living there for two years, Viki was generally happy with the community and ELS until October of 2013 when her home caught fire. Because there were no fire hydrants on the property, firemen were unable to reach her home in time, and Viki had to watch her home burn to the ground. She lost everything. The property managers told her that there was no such thing as hardship exemption on her monthly ground rent, and she would have to pay the remainder of the rent even though she had no home to live in.

Richard Robinson in Farr West, Utah has worked his entire life as a long haul trucker until he was severely injured on the job. No longer able to work, Richard and his wife Sondra moved into an ELS community to save money. After a few months, it became clear to Richard that ELS wasn’t investing in his community. Richard and his community members got together to make ELS fix the sidewalks and driveways and pave the streets so that his community was safe for the seniors that ELS was marketing to. Richard should not have to lobby ELS to do what it should be doing on its own: taking care of its communities.

So to Zell’s theory that the one percent work harder, I ask him to visit some of his ELS communities and see for himself who his tenants are. We worked hard all our lives and we had hoped to enjoy our retirement in a nice community. Our dreams have been shattered.

For more information about Sam Zell, ELS and what people living in ELS communities are doing to fight back, check out this video.

For immediate release – February 7, 2014

Citing disparaging remarks made about ELS’ Customer Base, Homeowners petition shareholders to oust Zell

Sam Zell: “1 Percent Earn More Because They Work Harder”

Contact: Kevin Borden, Senior Organizer

Contact Info: kborden@communitychange.org, 202-360-8876

Washington, DC – A coalition of seniors, veterans, people with disabilities and young families who reside in manufactured home communities owned and operated by Equity Lifestyle Properties, Inc. (ELS) are angered by disparaging comments made by company chairman Sam Zell about Americans who are not part of the richest 1%. On February 7 they launched a petition calling for Zell’s resignation as chairman of ELS after comments Zell made earlier in the week during an interview with Bloomberg News in which he declared that “The 1 percent work harder. The 1 percent are much bigger factors in all forms of our society.” You can watch the full quote here:

“Sam’s comments divide us further as a country. They do not bring us together to solve the important issues of economic inequality that affect every segment of our society,” stated Dale Muzzy of Daytona Beach, Fla., and president of the Carriage Cove HOA, an ELS-owned community. “I’ve worked extremely hard for decades at DHL and also became a full-time caregiver for my wife who was in a debilitating motorcycle accident. So I’m puzzled as to how Zell’s background qualifies him to know how hard I’ve worked.”

ELS is the nation’s largest corporate owner of manufactured home communities with 380 manufactured home communities (defined as land-lease communities) in 32 states. ELS serves over 140,000 homeowners, many of which are retirees and seniors living on fixed incomes.

“It is infuriating that someone who makes millions off of monthly rent paid by seniors is questioning our work ethics,” added Bobbie Hemmerich, a homeowner from an ELS Community in Lewes, Del. “ELS should view these comments as an embarrassment to their customer base. That’s why we launched a petition demanding Sam Zell’s ouster from the ELS board.” The text of the petition can be found here: http://act.retirementsecurityvoices.org/petition-zell

Manufactured homeowners across the country are banding together and calling upon ELS to re-evaluate its business model and management practices. Homeowners believe that a sensible alternative model for ELS is to put in place long-term lease agreements with fair and balanced rent increases and capital improvement processes. Additionally, ELS would be able to engender a higher level of customer loyalty by pushing for policies that protect and strengthen our nation’s Social Security and Medicare systems and ensuring that its chairman stop making disparaging statements.

For more information go to http://mhaction.mstudio.com or contact Kevin Borden at 202-360-8876 to set up interviews with manufactured homeowners who are leading the campaign.

###

SAN RAFAEL, Calif. (KGO) — The United State Supreme Court has affirmed a major victory for California mobile home owners protected by rent control.

ABC7 News has been following this case closely for the past five years, focusing on the Contempo Marin mobile home park in San Rafael. The park owner, Equity Lifestyle Properties, sued the city of San Rafael, claiming its rent control law for mobile homes was unconstitutional.

After a long legal battle, the Supreme Court has now refused to hear an appeal in the case. That means San Rafael’s rent control stands.

The decision is expected to protect mobile home residents in about 100 California cities and counties with similar rent control laws.

From WPBF News

VERO BEACH, Fla. —Dozens of residents at a retirement community in Vero Beach took to the streets Tuesday morning to protest along State Road 60.

They said they’re fed up because the clubhouse and streets are not properly maintained.

Cheryl Condo has lived at Countryside at Vero Beach for nine years. She said the 33-year old tennis court has cracks everywhere, while some of the pool furniture is broken and covered in black mold.

Condo said the property managers aren’t helpful.

“And when we tell them about things that need (to be) fixed, they go, ‘Too bad, we don’t have no money,'” Condo said.

Condo moved to the community nine years ago. She said it had beautiful landscaping and fantastic amenities to compliment the community’s 600 manufactured homes.

But she noticed the change a few years ago. Condo said residents pay about $300 to $800 in lot fees each month, but very little of the money is used to maintain the community.

Ed Nelson has lived at Countryside for 31 years. He said everything used to be included in the monthly fee, but now they have to pay for water, sewer and trash separately.

“They picked us so clean that even the buzzards won’t stop here,” Nelson said.

Resident said they will continue to protest until there’s a change.

The property is owned by Equity Lifestyle Properties. A spokeswoman from the Chicago office told WPBF 25 News in a written statement that the company’s “rents are in line with the market and have been agreed to by the community homeowners association on behalf of the residents.” She said the management team regularly meets with residents to hear their concerns, and improvements to the tennis and shuffleboard courts are “planned for the coming year.”

From the Cape Gazette

By Don Flood | Oct 29, 2013

Like many others before her, Bobbie Hemmerich retired here to enjoy the Cape Region’s chief attraction.

“I came down here with the idea of being able to walk the beach,” said Hemmerich, a lifetime “Jersey girl” who moved to Lewes in 2000. “New millennium, new life, new state – high hopes.”

It didn’t turn out that way.

“Both my knees went bad. I had double knee replacement and then I had complications,” Hemmerich said. “So I still can’t walk the beach.”

In some ways, her retirement plans didn’t work out any better than her knees. Instead of peacefully enjoying life, Hemmerich became an activist, with her main issue being the rights of manufactured home owners.

That’s a particularly important cause in Sussex County. Statewide, Delaware’s housing stock is about 10 percent manufactured housing. In Sussex, according to a 2008 study by the Delaware State Housing Authority, that percentage rises to about 25 percent.

Here’s another factor. According to that same study, about 57 percent of those manufactured home owners don’t own the land beneath their houses. They lease it, which makes them vulnerable to rapidly rising rent increases.

Before we go further, let’s clear up a common misconception about what are sometimes called “mobile homes.” They aren’t mobile. Not most of them.

Historically, yes. “The older ones were brought in on wheels and put on cinder blocks,” said Hemmerich. “But the newer ones, most of them, are being put on foundations.”

And, effectively, many of the older ones can’t be moved either. “Mine is a prime example,” said Hemmerich, whose home was built in 1976. “It has a stick-built addition … It has a deck. And if you tried to pull it out, it would probably fall to pieces.”

It gets worse. Even if it could be moved, there’s no place to go. “Any community that has open spaces will not accept anything older than five years old,” Hemmerich said. “And some of them now are saying only new. So where are you going to take it?”

Hemmerich bought her home, as she recounted in a 2004 letter to the Cape Gazette, because the neighborhood was clean, quiet, private, east of Route 1, and “it was affordable.”

But, like many others, she bought without being fully aware of the risks.

Despite being represented by an attorney, she was unable to get a copy of the lease. There was always some excuse. The fax machine was down, the computer was down, it was in the mail, etc.

“We didn’t get to see our lease until an hour before closing,” she said. “It was 27 pages … You can’t even read it. You kind of look through it … You’re stuck.”

Still, things seemed OK at first. Once-a-year rent increases were limited to 5 percent, and the monthly fee included water, lawn maintenance, trash collection and snow removal.

In 2003, everything changed. The company that owns her park, which now goes by the name Equity LifeStyle Properties, went to court to end the rent caps and won. Later, the Delaware Supreme Court affirmed the lower court’s ruling.

Manufactured home parks could still raise rents only once a year, but the limits were removed. On Nov. 1, 2003, Hemmerich received a letter from the company: In two months, her rent would jump from $275 a month to $320 – 16 percent. For a woman surviving on Social Security checks, that was a life-changing amount. (There were also hidden rent increases. Water usage, once part of the package, was removed, she said, and now has to be paid separately.)

And that’s when mild-mannered-retiree-turned-activist Bobbie Hemmerich first started work on a rent justification bill. This past session, 10 years later, the General Assembly finally passed Senate Bill 33, which was signed by Gov. Jack Markell June 30.

It wasn’t just Hemmerich by herself, of course, but she played an important role. According to Mitch Crane, chair of the Delaware Manufactured Home Relocation Authority, “Bobbie is one of the unsung heroes. Her efforts and tenacity, along with that of so many manufactured home owners, resulted in the rent justification law being passed after many previous attempts failed.”

According to the bill, rent increases are tied to the three-year average of the Consumer Price Index for all Urban Consumers. Park owners who want to raise rents more than that average must go through mediation and non-binding arbitration, appealable to Superior Court.

The bill doesn’t accomplish everything Hemmerich wanted, but it’s a start. A future column will discuss the legislative priorities of the Land Lease Homeowners Coalition, of which Hemmerich is a board member.

From Fox13 in Utah

FARR WEST, Utah – Utahns protested in Farr West on Saturday in response to increasing rent costs at a manufactured home community for seniors.

Protesters said many residents of Westwood Village, 1111 North 2000 West, are on fixed incomes and will not be able to continue living in their homes if the community keeps increasing their rates.

Resident Chris Hicks said her ground space rent has increased every year since 2008, which is when she moved in. She said she is keeping up for now, but she said she and other residents are concerned about what the future may hold.

“I’m starting to feel the squeeze with the ground increase,” she said. “I keep thinking, I’m a young person in this park, I’m 56 years old. What’s gonna happen in 30 years from now? I plan on staying here that long, as long as some of these other people. What’s gonna happen then?”

The owner of the complex, Equity Lifestyles Properties, is one of the largest owners of manufactured home communities in the nation. FOX 13 News attempted to contact them for comment regarding Saturday’s protest but did not hear back.

From the Standard Examiner

FARR WEST — Carrying signs and armed with determination, residents of the Westwood Village active senior home community staged a rally Saturday, protesting rent increases they say threaten their economic security.

Richard Robinson, the community’s homeowners association chairman, said monthly rent has increased nearly $200 in the last decade, since Equity Lifestyle Properties purchased the community. According to a Westwood Village news release, the monthly rate will be raised $21 to $432 next year, up from $382 in 2010 and $249 in 2002.

Since many of the residents of the community, at 1111 N. 2000 West, have fixed incomes — often based on Social Security — the yearly rent hikes have priced some people out of their homes, Robinson said. One resident who spoke at the rally said that at age 72, she’s even had to go back to work just to keep her home.

“Many people have left Westwood, walking away from their homes.” Robinson said. “They couldn’t sell them or pay rent.”

While the rent increases would be tough to swallow under any circumstances, the protesters claimed ELS has not used the money appropriately, to maintain or improve the community, instead pocketing the profit. Robinson cited the example of the community’s sewer system, which he said is in such disrepair that it needs complete replacement.

Connie Waite said that when she moved in seven years ago, ELS agreed to fix her driveway, a promise that has gone unfulfilled. Many others at the protest shared similar concerns about the lack of return on their rising housing costs.

“For them to keep increasing the cost is really putting (a strain) on us,” Waite said. Myra Close, treasurer of the National Manufactured Homeowners Association, said price increases like the ones at Westwood Village are happening at communities owned by ELS all across the country. Many of those communities also held protests Saturday, a date that coincided with ELS Chairman Sam Zell being slated to speak over the weekend at a manufactured housing forum in Chicago.

Holding a sign that asked “How much is enough?” Annette Tittenser accused Zell of taking advantage of the people who live in the hundreds of communities across the nation ELS owns.

“Sam Zell touts himself as a great mogul with real estate developments,” she said. “But he makes his profit off peoples’ Social Security.”

Close said she’d love to discuss the issues with ELS, but so far attempts to do that have been met with resistance.

“We want to be able to sit down with ELS and talk with them,” she said. “We haven’t been able to do that.”

Calls to ELS seeking comment were not returned Saturday.

For immediate release – October 16, 2013

Thousands of Manufactured Homeowners Across the Country Draw Attention To Attacks On Their Retirement and Economic Security

Homeowners Call Upon Sam Zell, Chairman of Equity Lifestyle Properties, Inc. (ELS), to Stop Economically Ravaging Their Personal Savings and Economic Security

Contact: Kevin Borden, Center for Community Change (202) 339-9356

Washington, DC – This week, manufactured home owners across the country are posting “For Sale: Our Economic and Retirement Security” signs on their homes. The signs are designed to draw attention to the devastating impacts that ELS’ exorbitant rent increases and lack of attention to needed capital improvements have had on thousands of manufactured homeowners’ economic and retirement security. Events across the country are being held to coincide with the Manufactured Housing Institute’s Fall Leadership Forum that is taking place in Chicago from October 16th to 18th. Sam Zell, Chairman of ELS, is the keynote speaker. Homeowners are posting pictures of those events and For Sale: Our Economic/Retirement Security at the following site: http://mhaction.tumblr.com/

ELS is the nation’s largest corporate owner of manufactured housing communities. ELS owns 380 manufactured housing communities (defined as land-lease communities) in 32 states. ELS markets to retirees, and many homeowners in its developments are seniors living on fixed incomes. ELS has come under scrutiny for undermining the retirement security of thousands of those seniors by drastically increasing rents, causing economic eviction, and being insensitive to the needs of the mostly elderly homeowners living in ELS-owned communities.

“I find it very troubling that Sam Zell is speaking at a manufactured housing forum entitled ‘Building a Vision For Our Future,” stated Bobbie Hemmerich, an ELS homeowner from Lewes, DE. “It appears to me that his vision is to force seniors and hard working families out of homes that they paid for while allowing our communities to deteriorate. That’s not a vision that is acceptable to us. A number of homeowners in our community have practically given their homes away due to poor business practices on the part of ELS.”

At MHI’s Fall Leadership Forum, community owners, like ELS, will be discussing a wide range of topics that include discussions on the future of the manufactured housing industry to exploring actionable steps that community owners can take to improve customer satisfaction.

“Living in Florida, it’s clear to me that some of the larger, corporate owners are not doing right by their customers, especially Sam Zell,” said Al Lynch, who lives in a community owned and operated by American Land Lease. “Our hope is that the large community owners don’t take a page out of ELS’ business model which seems intent on robbing seniors of a secure retirement. We need to show our support that all manufactured home owners are treated with dignity and respect.”

In response to ELS’ business practices and Sam Zell’s political contribution, ELS homeowners, supported by the Center for Community Change and the National Manufactured Home Owners Association, have launched a national campaign targeting ELS and Zell (you can learn more at http://mhaction.mstudio.com.).

The Center for Community Change (CCC) and the National Manufactured Home Owners Association (NMHOA) have called on ELS to re-evaluate its business model and management practices. CCC and NMHOA believe that a sensible alternative model for ELS is to put in place long-term lease agreements with fair and balanced rent increases and capital improvement processes. Additionally, ELS would be able to engender a higher level of customer loyalty by pushing for policies that protect and strengthen our nation’s Social Security and Medicare systems.

For more information go to http://mhaction.mstudio.com or contact Kevin Borden to set up interviews with ELS homeowners who are leading the campaign.

###

Founded in 1968, the Center for Community Change is one of the longest-standing champions for low-income people and communities of color. CCC seeks to confront the vital issues of today and build the social movements of tomorrow. For more information go to www.communitychange.org.

For decades, the National Manufactured Home Owners Association has represented seniors, veterans and the hundreds of thousands of Americans who live in manufactured housing communities. For more information go to www.nmhoa.org.

For immediate release

September 23, 2013

Homeowners Cite Sam Zell’s Ruthless Practices in Response to Glowing Forbes Article

Growing movement confronting Zell-owned Company That Markets to Retirees

Contact: Kevin Borden, Center for Community Change, kborden@communitychange.org | (202) 360-8876

Sam Zell is currently featured as part of an in-depth cover story in Forbes Magazine portraying the billionaire investor as a shrewd risk-taker who is willing to take a few hits in the service of long-term profit. However, homeowners across the country are speaking up about Zell’s more insidious entrepreneurial endeavors. The article fails to mention some of Zell’s properties characterized by drastic rent increases, economic eviction, and complete insensitivity to the tough reality of the mostly-elderly residents.

Among Zell’s investments is Equity LifeStyle Properties, Inc. (ELS), the nation’s largest corporate owner of manufactured home communities. Zell is the board chair of ELS, which owns 380 manufactured home communities (defined as land-lease communities) in 32 states. ELS markets to retirees and many homeowners in its developments are seniors living on fixed incomes.

“ELS has been able to push its share value to an all-time high by gouging manufactured homeowners, combining rent increases with decreased community services,” said Pam Bournival, a homeowner in an ELS manufactured home community in Sarasota, Florida. “This is the real Sam Zell: a vulture capitalist unconcerned about actual people. Unfortunately, Forbes created a glowing portrait of Zell that betrays reality.”

In the last two years, Zell and ELS have faced increased scrutiny of the company’s management practices, including protests at recent shareholders’ meetings. In 2012 a group protested outside the shareholder meeting, questioning Zell over exorbitant and unfair increases in lot rents, and delivering a petition to stop economic evictions. The homeowners, supported by the Center for Community Change and the National Manufactured Home Owners Association, have launched a national campaign targeting ELS and Zell (you can learn more at http://mhaction.mstudio.com.)

Zell is also undercutting the economic security of seniors and people with disabilities by funding politicians and political action committees that are bent on dismantling the cornerstones of our nation’s retirement security programs: specifically, Social Security and Medicare.

“I was raised to believe that great business leaders had a moral compass and were supposed to make contributions to the broader society as a result of their success. With Sam Zell, it’s just the opposite,” said Bobbie Hemmerich, a homeowner from an ELS community in Lewes, Delaware. “Under his guidance ELS seems intent on robbing seniors – mostly women – of a secure retirement. To add salt to the wound, he gives big political contributions to politicians who want to gut Social Security and Medicare.”

The Center for Community Change (CCC) and the National Manufactured Home Owners Association (NMHOA) have called on ELS to re-evaluate its business model and management practices. CCC and NMHOA believe that a sensible alternative model for ELS is to put in place long-term lease agreements with fair and balanced rent increases and capital improvement processes. Additionally, ELS would be able to engender a higher level of customer loyalty by pushing for policies that protect and strengthen our nation’s Social Security and Medicare systems.

For more information go to http://mhaction.mstudio.com or contact Kevin Borden at (202) 360-8876 to set up interviews with ELS homeowners who are leading the campaign.

###

Founded in 1968, the Center for Community Change is one of the longest-standing champions for low-income people and communities of color. CCC seeks to confront the vital issues of today and build the social movements of tomorrow. For more information go to www.communitychange.org.

For decades, the National Manufactured Home Owners Association has represented seniors, veterans and the hundreds of thousands of Americans who live in manufactured housing communities. For more information go to www.nmhoa.org.